401k tax penalty calculator

401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will result in a penalty. Forms Instructions Publications.

How To File Irs Form 1099 R Solo 401k

It allowed withdrawals of up to 100000 from traditional or Roth 401 k for 2020 only without the 10 penalty for those under age 59½.

. TIAA Can Help You Create A Retirement Plan For Your Future. Calculate your earnings and more. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

You may reduce future penalties when you set up a payment plan. A 401 k can be an effective retirement tool. As mentioned above this is in addition to the 10 penalty.

2000 would go to the 10 penalty. Ad If you have a 500000 portfolio download your free copy of this guide now. Divide 1700 by the number of pay periods remaining in the year and add the result to whatever the IRS Tax Estimator determines for the Extra withholding that needs to be shown on line 4 c of the Form.

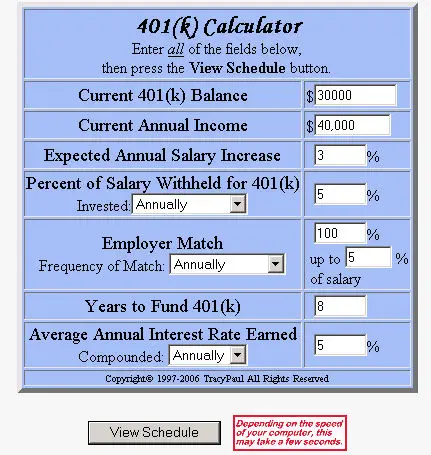

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate and your expected annual rate of return. For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take home 14400. It provides you with two important advantages.

The money you withdraw from your 401k is taxed at your normal taxable income rate. The amount of the. Your 401k plan account might be your best tool for creating a secure retirement.

TaxInterest is the standard that helps you calculate the correct amounts. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. In addition to regular income taxes you will.

If you cant pay the full amount of your taxes or penalty on time pay what you can now and apply for a payment plan. 401k IRA Rollover Calculator. But there are often many reasons to.

Yes you must factor in the 1700 penalty yourself by adding the 1700 to the Total tax liability after credits determined by the estimator. Taxes Affecting a 401 k Hardship Withdrawal. In some cases its possible to withdraw from retirement accounts like 401 ks and individual retirement accounts before your retirement age without a penalty.

Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b. We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed on or before the due date.

10 Tax for Early Distribution from Retirement Plan. You only pay taxes on contributions and earnings when the money is withdrawn. We calculate the penalty based on.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation.

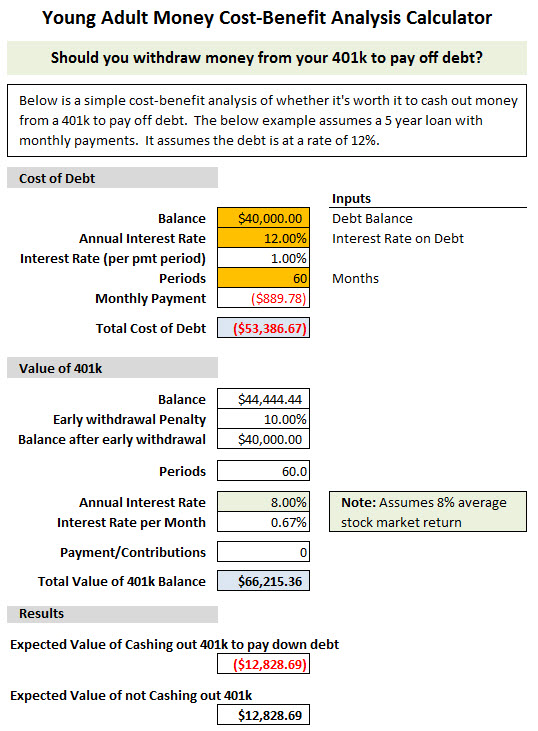

100 Employer match 1000 Limit on. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

As of January 2006 there is a new type of 401 k-- the Roth 401 k. It is mainly intended for use by US. Ad Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. The Roth 401 k. Dont Wait To Get Started.

The tax shown on the return is your total tax minus your total refundable credits. Publication 1 Your Rights as a Taxpayer PDF Publication 3498 The. Plus many employers provide matching.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset growth tax consequences and penalties based on information you specify. Using this 401k early withdrawal calculator is easy. You will pay taxes on the amount you take out in the form of a hardship withdrawal.

With a click of a button you can easily spot the difference presented in two scenarios. This guide may be especially helpful for those with over 500K portfolios.

401k Retirement Withdrawal Calculator Best Sale 60 Off Www Ingeniovirtual Com

401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Taxes On Retirement Accounts Ira 401 K Distributions Withdrawals

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

How To File Taxes On A 401 K Early Withdrawal

401 K Calculator Credit Karma

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

Beware Of Cashing Out A 401 K Pension Parameters

Free 401k Retirement Calculators Research401k

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Bear Markets And Your 401 K

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

What Is The 401 K Tax Rate For Withdrawals Smartasset

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

401k Retirement Withdrawal Calculator Outlet 60 Off Www Ingeniovirtual Com